Table Of Contents

A Massive Decline in SEK/USD Based on US Employment Data

Currently, the US economy is extremely robust and going strong. However, the known pair of USD/SEK is trading lower indicating a fairly downbeat momentum for this particular pair.

However, the US economy is now trying to pull its socks up to make a recovery for the Dollar. Why? Because this fuels hostile bets on the Federal Reserves.

On the other hand, the SEK also witnessed some downward pressure since Wednesday when the Riksbank decided to cut the rates by 3.75%. This was also an alarm that more cuts are coming to it, gradually.

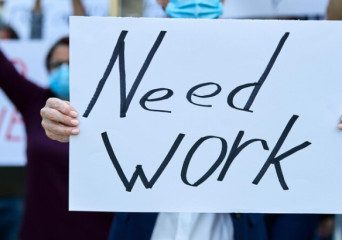

The USD is feeling a tad bit of downward pressure that follows the release of disappointing initial jobless claims data. This week, people kept filing for jobless benefits, and the numbers rose to 231K. This has surpassed their previous expectations of 210K and 209K.

This run-up in the jobless claims has overall enhanced the concerns of weakening the conditions prevailing in the labor market.

However, this doesn’t change the market expectations of the Feds. The investors are now still observing the easing cycle that started in September. Now, all eyes are going to turn to next week’s inflation data. This is the source from where the US sets the tone of market expectations of the Feds.

Furthermore, the technical analysis of USD/SEK says that the RSI is now navigating towards a positive territory. Additionally, the histogram of MACD indicates several red bars. It demonstrates a negative momentum.

The simultaneous coexistence of the positive regions of RSI shows that even though the promising players are largely dominating the market, through price, the overall trend is maybe a lost cause. This hinted at a potential shift in the overall momentum created in the market.

Related Post:

Governor Mills Signs Executive Order to Promote Women’s Employment in Construction Sector